Times are tough for a lot of people right now. You may have lost your job or your business may be struggling, and you may be wondering how you will pay your bills. Some people think about taking out a payday loan when they need cash fast, but think twice. Payday loans are the most expensive way to borrow money, and they can trap you in a cycle of debt.

Let’s be honest. The option of asking for a loan and getting cash the very same day is attractive. And that’s the allure of these loans. For those who struggle to pay rent or pay bills that will keep them afloat or maintain the status quo for their families, it’s difficult to say no when you’re in need. If you’ve had to make that choice, don’t despair. Just know these types of loans are not your only choice. First and foremost, educate yourself. Let’s take a look at how payday loans work.

Give us a call anytime to chat with a personal financial representative and learn how we can help.

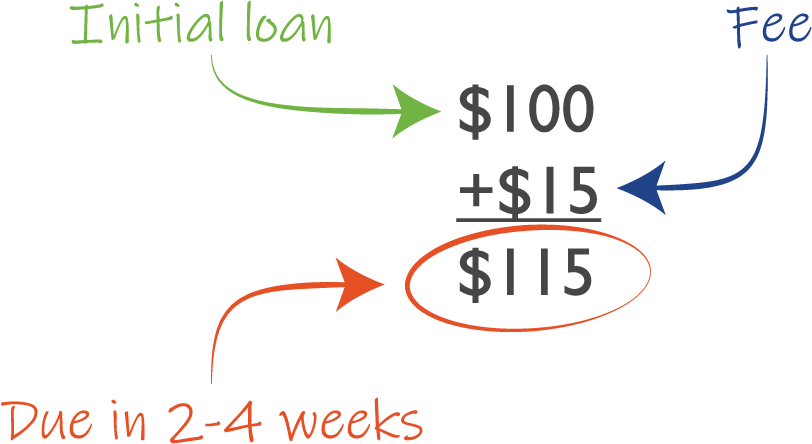

A typical payday lender charges $15 to loan you $100. To get the cash, you provide the payday lender with access to your personal checking account or a post-dated personal check for $115, the amount of the $100 loan plus the $15 fee. The payday lender will deposit that check or retrieve the funds electronically on the day the loan is due. But, there is more than one catch. Below are five reasons why payday loans are not the best option for your overall financial health, even if they appear to serve your immediate needs. And then we’ll explore some healthy alternatives.

- Payday loans are the most expensive way to borrow money. Payday loans come with fees. It’s not a loan with an annual percentage rate (APR), but one way to compare the cost of different loan options is to calculate the APR. According to the US Consumer Financial Protection Bureau (CFPB), “This equates to an annual percentage rate of almost 400% for a two-week loan.” In comparison, the average APR for most credit cards is less than 20%, or you could likely get a much lower rate on a personal loan from a credit union, as they are regulated to protect consumers. UFCU offers competitive rates and fees, and our representatives are happy to talk to you about your options and your unique needs.

- Repaying a payday loan on time will not improve your credit score. Most payday lenders do not report their activity to the major credit bureaus. Therefore, you will not see an improvement to your credit score when you repay the payday loan on time.

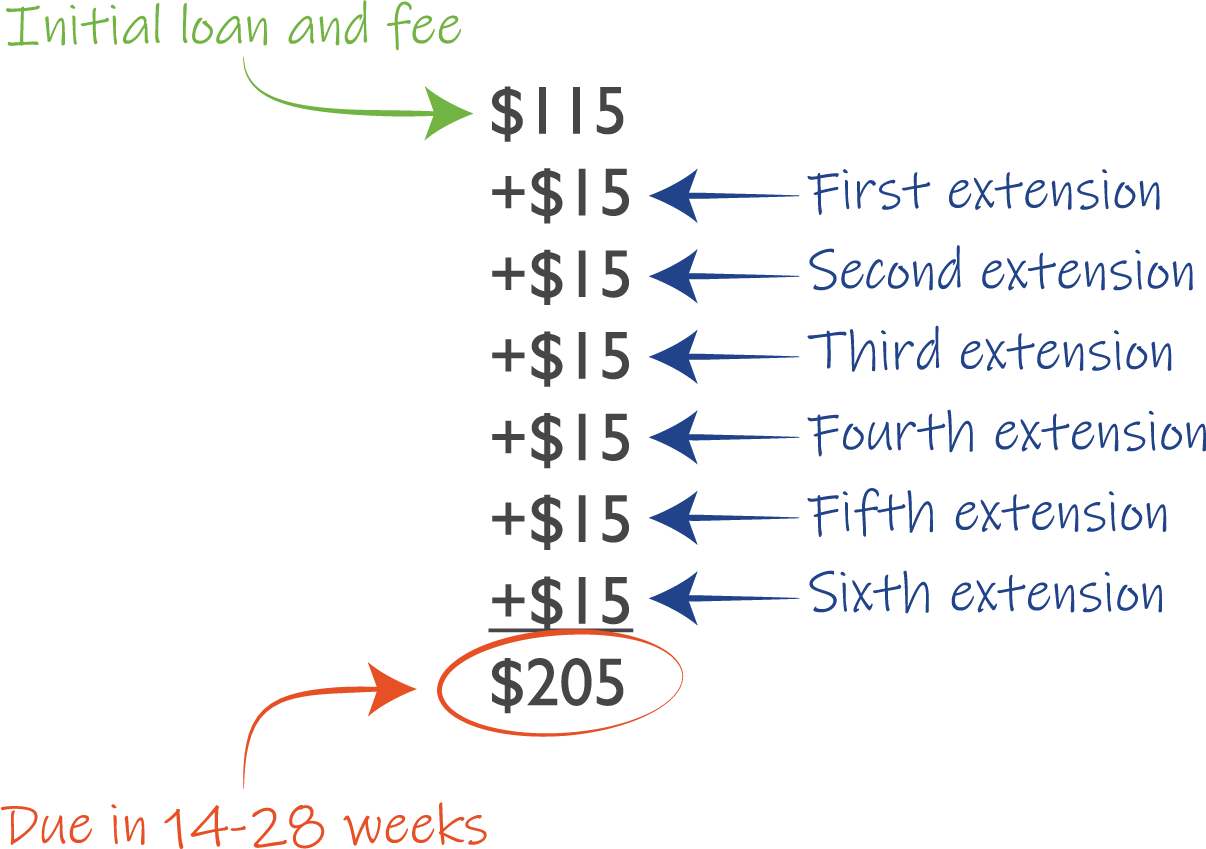

- Payday loans are due very quickly. Most payday loans are due in two-to-four weeks, or by the borrower’s next paycheck. Few borrowers are able to come up with the cash to repay the loan that quickly. The CFPB found that about four out of five borrowers extend their payday loans.

- Extensions mean more fees. Most borrowers that can’t pay back their payday loans on time ask for an extension, often called a rollover, where the payday lender allows you to pay only the fee on the due date and charges you an additional fee for extending the loan. For example, if you extend a $100 loan three times, paying the original $15 fee plus an additional $15 fee for each extension, that essentially amounts to $60 in penalty fees. The CFPB has reported that almost a quarter of payday borrowers have to extend their payday loans six times or more.

- Defaulting on the loan may mean more fees and bigger credit problems. If you can’t pay your payday loan on time and don’t get an extension, the payday lender could deposit your check or access your funds electronically, which could result in overdraft charges from your bank if you don’t have enough funds. If you can’t pay, and the payday lender turns your case over to a collection agency, that activity will be reported to the credit bureaus and the default will hurt your credit score. Also, you could be sued for the outstanding amount, and your wages could be garnished to repay the amount if a court finds against you.

Consider these alternatives to payday loans when you are strapped for cash.

- If you need a small loan, consider an emergency relief loan. These loans are small, short-term loans with a more reasonable payback period, usually several months instead of weeks. They are federally regulated, all fees are disclosed, and the APR is competitive. Also, most credit unions will talk with you about your ability to repay the loan before the loan is finalized to help you think through whether that loan is the best option for you.

- Talk to your creditors, landlords, and service providers as soon as possible. Especially in this time of crisis, many can either defer payments or work out a payment plan when you contact them before the bill is due. Credit unions in particular offer deferred payment solutions that mean you might be eased of the pressure of coming up with fast cash. Don’t feel guilty about the situation you’re in, and don’t be hard on yourself. Many people are struggling. If you take the time to be proactive and try to improve your situation, you will find that many institutions are willing to help.

- Find out what emergency or crisis assistance is available in your area. You may be eligible for government benefits, such as unemployment, disaster relief, or assistance with health care, housing, or childcare. Many nonprofit organizations also provide aid with food banks or help meeting other daily needs. If you’re in need of assistance as a result of the Coronavirus, please reach out to us or learn what community resources are available to you at UFCU.org\COVID19.

Before you take out any loan, research and compare your options, and get the facts. Find out all of the fees, and take a serious look at your budget to make sure you can successfully repay the loan and stay out of the debt trap.

Thank you for your feedback.