Guard Against Fraud

Scammers are out there, and they are costing Americans a lot of money. In a report released in 2024, the Federal Trade Commission (FTC) estimated that Americans lost over $10 billion dollars to scammers in 2023, up by about 14% from the previous year. According to the report, identity theft and imposter scams were the two biggest ways Americans lost their money to fraudsters.

Arming yourself with knowledge is a powerful way to protect yourself. Here are some tips to help you guard against fraud:

- Protect your Personal Identifiable Information (PII) — Never share your personal information, especially when requested from unsolicited sources via phone calls, emails, texts, or any other means.

- Choose strong usernames and passwords — The strongest passwords are made up of a string of random letters, numbers, and symbols. Never use the same password or username for multiple applications and use a unique password to log in your UFCU account.

- Learn to spot scam applications and websites — Cybercriminals will try to trick you into revealing your account information by disguising a phony application or website to look like UFCU. The application or website may even have stolen our logo and images. The phony site will ask you to enter your banking information. Avoid these sites by not clicking through to websites from an email or text. Always access UFCU.org directly by typing our web address into your web browser.

- Hang up on phone spoofing attacks — Fraudsters posing as UFCU Fraud Representatives may call you to discuss “fraudulent transactions.” Their goal is to obtain private information, such as your social security number, personal identifiable information (PII), username, login passcode, or a one-time passcode. Do not give out this information. Instead, hang up and call UFCU at (512) 467-8080 or (800) 252-8311.

- Outsmart accidental deposit scams — Scammers may send you funds and then contact you and claim that the funds were sent accidentally. They’ll then ask you to send the funds back through a payment service, usually a cash app. If you receive these “accidental deposits,” never send the money to the fraudster or spend it. Instead, contact UFCU immediately to report what happened and we’ll help you resolve the situation.

- Delete phishing scams — Scammers may send you an email with links embedded. Do not click on those links. The links will take you to a fraudulent website where you will be asked to log in with your username, password, and possibly a one-time passcode or authorization code. As soon as you provide those details, fraudsters can use them to gain control of your account.

- Thwart gift card scams — A scammer may tell you to buy a gift card, like one for Google Play or Apple, and give them the number off the back of the card. Do not fall for this trick. No real business or government agency will ever tell you to buy a gift card for them.

Keep These Tips in Mind

- Never send money to anyone who claims your account is compromised or threatens to cut off your services.

- If in doubt, immediately end the call and call UFCU at ((512) 467-8080 or (800) 252-8311.

- Do not use search engines to access UFCU. Always go to www.UFCU.org directly or use the UFCU Mobile app to sign into your accounts.

- Report any suspicious activity immediately. Call (512) 467-8080 or (800) 252-8311 so that our Member Services Representatives can help you.

Ensure Your Privacy

Ensuring your privacy means following best practices to protect all of your personal and confidential information. It’s important to be diligent about keeping others from having access to the information that can identify you, including your social security number, PIN number, account numbers, credit card numbers, and even your address and birthdate.

Your security is our top priority. UFCU will never call you and ask for private information, such as your digital banking username and password, PIN, Social Security Number, or One-Time-Passcode (OTP). If you receive a call like this, please hang up and call us directly.

But there are fraudsters that may try to get personal information from you. We want to help you recognize when someone is trying to trick you into divulging personal information that could allow them to access your account so that you can keep your account safe. A fraudster may call you using a number that appears to be from UFCU and pretend to be a UFCU Fraud Representative. Others may send an email or text message pretending to come from UFCU. However they try to contact you, these fraudsters are hoping they can convince you to provide them with private information or to perform actions that compromise the security of your account.

UFCU will never contact you to ask for your private information. If anyone asks you for the following details, they are not from UFCU. Do not give others this information:

- Login credentials (username and passcodes)

- Social security number

- One-time passcode

- Personal Identification Number (PIN)

- Personal Identifiable Information (PII)

- + How Can I Protect my Personal Information?

There are proactive steps you can take to help keep your account secure:

- Never share your username, password, social security number, Personal Identification Number (PIN), or one-time-passcode with anyone.

- Do not use your UFCU login username and password to access any other applications.

- Be wary of any phone call, text, or email requesting account information that claims to be from UFCU. We will never request your account number, password, or other personal information by unsolicited phone calls.

- Do not click suspicious email links or text messages. UFCU will never send any message that provides a link to your account or requests your card number, username, or password.

If you receive a suspicious phone call, email, or text claiming to be from us, hang up the phone or delete the email or text and contact Member Services at (512) 467-8080.

UFCU's Privacy Policy

To learn more about the how UFCU protects your personal information, read the UFCU privacy policy.

Understand Cybersecurity

Cybersecurity includes all the measures you can take to protect your computer and online systems against unauthorized activity via the Internet.

- + What Should Be in My Cybersecurity Plan?

Keep these basic tips in mind as you develop your own cyber-security plan:

- Safety applies to every user of a computer or device, adults and children alike.

- Teach your children never to post personal information or engage with strangers online.

- Establish clear rules for children about using the Internet, and create open lines of communication. Encourage them to tell you about their activities and experiences online.

- Limit the time your children spend online and create simple guidelines that the whole family can follow.

- Consider keeping computers in a common space in your home.

- + What Are Some Common Cybersecurity Threats?

There are many types of cybersecurity threats you should be aware of:

- Identity theft and fraud — Any types of crime in which someone obtains and uses another person's personal data in a way that involves fraud or deception, typically for economic gain.

- Hackers — Generally refers to any person who bypasses security measures for malicious purposes or criminal activity.

- Phishing — Emails that appear to be from a reputable business (often a financial institution) and attempt to gain personal or account information. Never enter personal information into an online form you accessed via a link in an email. Legitimate businesses will not ask for personal information online.

- Malware, short for malicious software, is any software that is specifically designed to damage, disrupt, steal, or inflict some other “bad” or illegitimate action on data, hosts, or networks. There are multiple types of malware:

- Viruses — Propagate by inserting a copy of itself into another program, so it’s installed along with that program.

- Worms — Replicate functional copies of themselves to cause damage, but do not require a host program or human help to propagate.

- Trojans — Software that looks legitimate, but is not. Victims are typically tricked into loading and executing it on their systems.

- Spyware — Also known as adware, software that may send you pop-up ads, redirect your browser to certain web sites, or monitor the websites you visit. Some extreme, invasive versions of spyware may track exactly what keys you type.

- + How Can I Help Protect Myself?

Cybersecurity is everyone’s responsibility. As a UFCU Member, you are part of our security. We ask that you practice the following fundamental online security tactics to help protect yourself:

- Update your operating systems and apps when updates are made available to make sure you’re taking advantage of the latest security features.

- Don’t log in to public WiFi networks from any of your devices. Public networks can provide potential hackers with easy access to your activity.

- Be skeptical of online relationships. Healthy skepticism can keep you safe. Don’t agree to make transfers through your credit union accounts for individuals you don’t know personally.

- Always use a secure connection. Use the UFCU Mobile Banking app or UFCU Online Banking via a secure connection to regularly check your account activity.

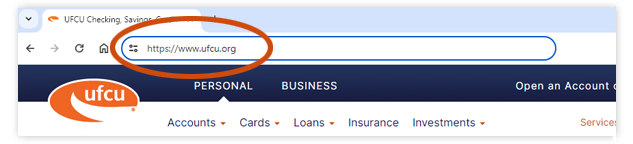

- Before you log in to Online Banking, always confirm that you are visiting our actual website (https://www.UFCU.org) as shown below.

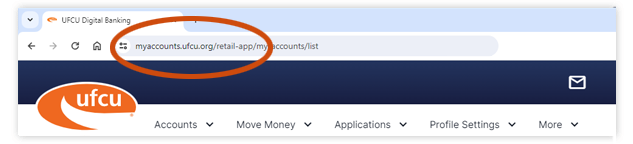

- After you have logged in to Online Banking, always confirm that you are visiting our actual website (https://my.UFCU.org) as shown below.

Unfortunately, many fraudsters attempt to mimic legitimate websites, with the intention of stealing IDs and passwords. If you're ever unsure about anything, remember that you can always contact us.